1. Focus on engaging content marketing and SEO (Inbound Marketing)

"But as good as my brand's services are, they really aren't interesting enough to make engaging content from."

We've heard this way too much before and though it may (or may not be) true - that's not the point. The lesson here is to change the way you think about content, and the best way to understand what I mean here is to answer this question yourself, as if you were someone included in your target market:

Which headline are you more likely to click on?

i) "Take Equity Investing to the Next Level with [product x]"

ii) "2019 Trends in Financial Services and How to Get More Bang for Your Buck."

Obvious winner right?

See how the 2nd option speaks to the brand's 'buyer personas'? and option 1 is just too generic to work any kind of charm?

“A buyer persona is a semi-fictional representation of your ideal customer based on market research and real data about your existing customers (considering their goals, beliefs and most importantly, pain-points).”

So now that you understand the new direction you need to choose for increased engagement, there are some other essential considerations:

Search Engine Optimisation

If your content isn't cleverly optimised for search engines, it won't get found by your buyer personas and the engagement it receives won't gain momentum over time.

We know that investing in great content isn't cheap, but if you really develop and optimise it properly, organic traffic to your website will undoubtedly deliver the most return out of all your marketing initiatives in the long-term.

Don’t believe us?

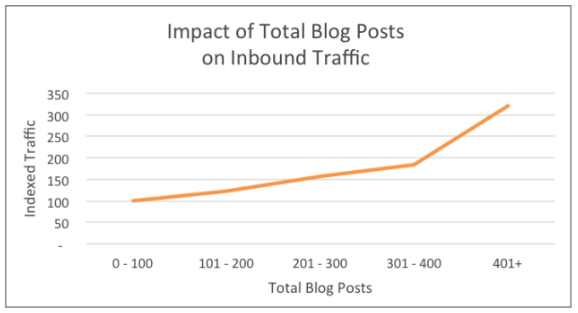

Did you know that companies that blog generate 55% more website visitors, 97% more inbound links, and get 67% more leads than companies that don’t blog? (Neil Patel)

So how often should you blog?

Data suggests that companies that publish 16+ blog posts per month got almost 3.5X more traffic than companies that publish between 0 - 4 monthly posts, and about 4.5X more leads. So - as often as feasible.

Blogging tips for the finance industry

- Spend time researching your buyer personas.

- Create a content calendar but remain flexible

- Avoid financial jargon

- Cite credible sources

- Tap into in-house knowledge

- Interview people

- Vlog!

Just as the T-Rex ruled the Cretaceous Period, video rules the digital marketing landscape of today.

- 59% of executives say they would rather watch a video than read text

- Social video generates 1200% more shares than text and image content combined

- Brands that use video marketing grow their year-over-year revenue 49% faster than brands that don’t.

Click here to watch our video trends video

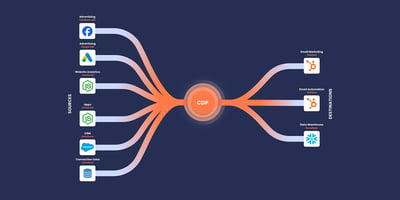

2. CRM (Customer Relationship Management) Platforms Empower Digital Financial Services Strategies

1. What do CRM platforms give financial services brands?

Efficiency. Like a kind of framework for your business's hivemind, leading CRM platforms centre around the idea that a unifying, integrated and data-rich foundation of communication drastically improves your profitability now and in the long-term. Leading CRM platforms allow you to create customer personas used in segmentation and this data becomes invaluable to sales and marketing departments.

A good CRM tool allows anyone (who’s granted access) to track individual clients’ progress through the funnel, compile and store customer data, track communications, and most importantly, help you execute data-driven strategies for improvement.

Through transparency and data-capture, CRM platforms bring employees from different departments together for the sake of their common goal and make it easier for individuals to understand how to show care, create relationships, satisfy needs and serve. That’s what it’s all about.

2. Choosing a CRM Platform

As far as your choice of platform is concerned, the array of decent options available is expanding and the barriers to entry are at an all-time low. Meaning that the best CRM will depend on your business model.

At MO Agency, we use HubSpot CRM and recommend it to most clients (especially in the Financial Services. It’s reputable, has a free version, and because of its user-friendly integrations, we have a much better idea about what our next course of action should be with particular prospects and clients.

For more on CRM, read What CRM Should I Choose in South Africa (26 minute read) or, What is the Easiest CRM to Use? (5 minute read)

3. Gated, Downloadable Content for Financial Services

eBooks | infographics | whitepaper guides | interactive tools | webinars

These types of longer-form content are really useful assets to have in your arsenal, and are essential when it comes to generating leads.

How?

Usually a longer piece of content (such as an eBook) is gated by a landing page. To gain access to the content, prospects must enter their details (name and email address at the very least). Essentially, you “pay” for the content with your email address. With regards to interactive tools (like for example if you built a tool to help people calculate tax payable for the year based on input earnings) you could request an email address in exchange for the tool’s output.

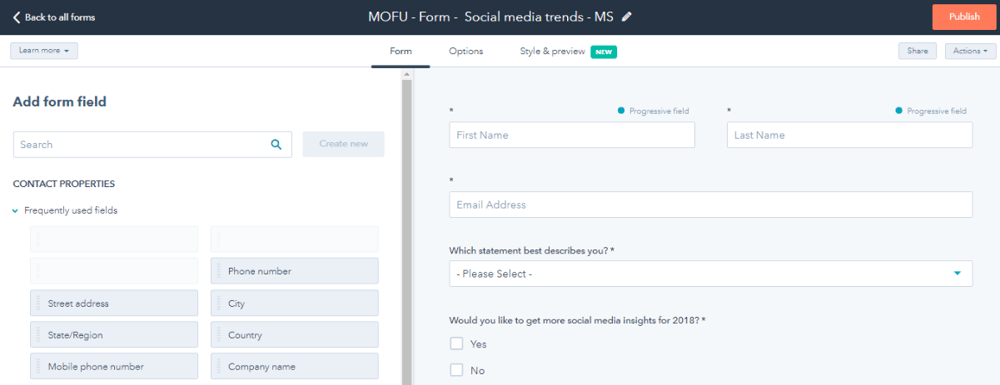

For most companies starting out with inbound marketing - once you have an email address for someone who is consuming your content - they become a lead, which you can then nurture towards becoming a customer with more relevant content. With each interaction, you should aim to get more information about them (such as company size, industry, phone number). This is done using progressive profiling, which refers to iterative forms that enable you to designate which questions appear in a form based on what you already know about that particular lead.

By employing progressive profiling technology, every time a lead fills out a form, you are progressively collecting valuable new information about them while keeping your forms short and easy to complete. This enables you to build up the amount of information, or intelligence, you collect about your individual leads without causing more friction in the conversion process. The more intelligence you build up about a lead, the more personalised an experience from prospect to customer you can offer.

Screenshot taken from within the HubSpot portal

Gated content tips for Financial Services brands

- Create Step-by-step content.

Whether you are creating ebooks, hosting webinars, or designing infographics, strive to present “how tos” in step-by-step detail. Your audience will love you for it. When it comes to complex scenarios, it is wise to use real-life examples.

- Make your landing pages shine.

Landing pages typically gate your long-form content. For many companies, landing pages generate a sizeable portion of their organic traffic. It’s worth remembering that if your landing page ranks in organic search, it may be the first point of contact someone has with your site - so make sure it speaks for itself. Push the form and explanatory text as high up the page as you can – this will help with conversions.

- Invest in building tools to make your audience’s life easier.

Whether it’s a tool that calculates tax payable as mentioned above, a budgeting tool, or a tool that delivers an investment plan based on data the users input, building tools your audience loves will help to supercharge your lead flow. Tools take expertise to build, and are more costly than traditional long-form content. However, the right tool can dwarf your other content in the long run in terms of lead generation.

HubSpot’s website grader is a prime example of this, having graded over 4 million websites since 2006.

- Include a key/jargon buster.

A really great idea is to include a jargon buster just after the introduction of your eBook. This means that your readers can refer back to a key if they need to. A jargon buster makes your content instantly more accessible and digestible.

- Report on unique data.

Interviews are a great way to save time getting great content on your blog, but for data-driven posts or longer form content, it’s important to be relevant and accurate. Cite data from trusted sources only, or run your own data collection.

Surveying your clients or the general public using free survey tools like HubSpot or SurveyMonkey to collect data. Survey data is unique and you can answer questions that other people aren’t by designing your own survey. For example, those in banking could report on the change in the number of people planning to take out a mortgage year-on-year. Insurance companies could report on the increase of people taking out insurance on brand new cars. There are endless opportunities when it comes to data-driven content.

Lose your navigation, and make the landing page less about your brand and more about your content. Summarise clearly what the value is of the content your landing page visitor is about to download. And don’t forget those progressive forms!

- Experiment with co-marketing.

A great way to expand your reach is by doing some co-marketing with a relevant partner. One example would be for a mortgage broker to write an ebook with a surveyor or real estate agency for tips on buying your first house. The ebook will not just carry more credibility, but you can also agree for it to be promoted to both your databases, which helps to broaden reach substantially.

4. Social Media

For some finance companies, social media is a place that is feared. However, for others, it is a place of great engagement and lead volume. Some companies even use it as a customer service channel.

In a report by research company, Mintel, it was found that 36% of consumers are comfortable with brands interacting directly with them on social channels and are significantly more likely to be satisfied with their financial services provider across a range of factors including the branch, ATM, website and mobile app. This suggests that a proactive social media strategy is critical because the more you can get your customers to engage with you on social media, the more satisfied and loyal they are likely to be.

5 social media tips for the finance industry

1. Avoid being over promotional.

The safest way to sidestep this challenge is to avoid using your social media channels to sell; use them to educate and inform. Use them to promote your helpful content (tips for saving for a wedding/holiday/car); show how your institution is helping serve the wider community through charity work; or run some competitions.

2. Know the rules of engagement.

Follow the ratio guidelines regarding publishing right balance of content.

First, there’s the basic 5-3-2 rule that states for every 10 posts:

5 posts should be content from other sources that are relevant to your audience, otherwise known as curation, 3 should be content you've created, that's relevant to your audience, or creation and 2 should be personal, fun content that humanizes your brand to your audience, to be referred to as humanization.

Then there’s the more, “inboundy” 10-4-1 rule which says for every 15 of your social media updates:

10 posts should be your own blog articles, 4 should be pieces of other people’s content and 1 should be a landing page.

Make it a rule to follow your own version/combination, using these ratios as a guide (because they work). It will help you grow your reach, send traffic to your website and generate leads.

3. Devise social media guidelines.

Set out strict social media guidelines that your employees can use. These need to be written in a way that is understandable by everyone. It should be very clear in terms of what employees can and cannot do on social media. This document should be covered at length during training.

4. Make use of video content - it works.

To give you an idea of how important video content is for your digital marketing, here are some key statistics:

- Social video generates 1200% more shares than text and image content combined.

- By 2020, online videos will make up more than 80% of all consumer internet traffic.

- Using the word “video” in an email subject line was found to increase open rates by 19% and click-through rates by 65%.

- YouTube is the second most trafficked site, after Google.

- Including video on landing pages can increase conversion rates by 80%.

If you'd like to see an example, check out these videos we produced for EasyEquities (Best Tax Free Saving Account provider)

5. Utilise fine-targeting with paid social media spend

Platforms like Facebook and LinkedIn allow brands to reach specific groups of people (preferably your target personas) with messaging designed to resonate with them. And this becomes incredibly powerful when these social messages point prospects towards landing pages which collect information. Using LinkedIn as an example, it is possible to send a promoted message from an expert in your organisation that goes directly to your target personas' inboxes! You can target them based on their job title, industry and years of experience. Are you imagining the possibilities?

Yes - it does take a lot of skill with the platform to get your cost-per-send down to a level that's feasible because social media platforms can be fickle. It takes someone who really understands them and how quickly they're changing through every-day experience to get you the finest targeting and the lowest cost. Not to mention - the copy, images and calls-to-action that get more leads.

6. Develop a crisis plan.

Social media failures are never good for any company, but in the finance industry, they can be particularly detrimental. That's why it's so important to outline a step-by-step process that should be followed if something happens on social media that shouldn’t have - such as negative interactions or a hacked account, for example.

This is sometimes referred to as an escalation guide. It should outline points of contact. If hacked, usually the first port-of-call would be to change your password, log-out and log back in and report the hack to Facebook (the most commonly used and thus commonly hacked platform). Perhaps then you’d release a statement and apologise for any confusion if necessary.

6. Email Marketing tips for Financial Services brands

Many marketers think email is dead, and that it’s an old-fashioned marketing tactic that doesn’t work anymore. Let's uncover why this couldn’t be further from the truth.

Email marketing is still one of the most powerful tactics in every marketers toolkit - it's just been modernised and empowered with digital technology like marketing automation.

In the finance industry, email is often an afterthought, being used primarily for operational alerts - such as deposit and withdrawal confirmation, policy updates, and statements - rather than for marketing communications too. There is a huge opportunity here - particularly when it comes to nurturing leads through the funnel from prospects to customers.

1.Run an opt-in, 'financial trends' newsletter.

Create a weekly/monthly opt-in newsletter that is full of diverse info and snippets of industry happenings. Accent on 'industry happenings', rather than boring, product specific information. Also, a classy layout and use of imagery is recommended.

2. Keep track of metrics, and test, test, test.

You should keep an eye on metrics like bounce rate, open rate, click-through rate, and so on. A CRM platform like HubSpot will make this so much easier, and you’ll be split-testing your way to glory in no time. Test subject lines, images, length, and format to figure out what is working best.

According to HubSpot research, the finance industry has an average open rate of 40%.

3. Maintain your lists

Make sure to spend time segmenting your lists into segments that make sense for your industry - that could be by customer type (personal/business), product type (current/ savings account or life assurance/car insurance) and geographic location. It’s important to audit these lists regularly, ensuring the list criteria are still relevant.

4. Use email to leverage other parts of your digital Financial Services strategy.

Use email to drive people to relevant blog posts, to alert them of competitions or referral schemes you’re running, or to get them to share or follow you on social media. Remember email subscribers are often the most engaged in your network, so tap into them.

5. Use email personalisation

It’s amazing the number of generic emails sent on a daily basis that are not personalised - even with a name. Do not commit this crime! Regardless of what email system you’re using, personalising your emails with at least a name shouldn’t be difficult.

Choosing a reputable CRM platform makes this a lot easier and more efficient, and there are a few good options out there. We usually recommend HubSpot for it's ease-of-use regarding key features. With HubSpot, you’ll easily personalise your automatic emails that not only greet the person by name, but also serve up content that they’re more likely to be interested in based on their previous interactions with your website and content. The HubSpot integration, bringing automatically compiled lists and email marketing automation together, is a real gamechanger.

6. Be strategic

Let’s take an example from the insurance industry. If you are marketing an insurance company, make sure to communicate with people at key times - such as when they are due to renew. Make sure that they receive a renewal reminder email a few weeks before. This should be easily set up within an inbound marketing platform using email workflows and content/list-triggered emails.

Conclusion

Digital strategy has come a long way in the last decade because of the technology that enables such incredible results as well as human efficiency improvements. And if you choose not to adapt, it's like choosing not to gain and maintain a competitive edge.

If you'd like more help in the pursuit of a leading digital marketing strategy that takes less of your time and get more results, we highly recommend learning more with our Executive Guide eBook linked below called Best Digital Strategies for Financial Services in 2019. It expands on all the above and includes great examples to get your ideas flowing...